摘要:LightCounting发布25G和50G PON的研究报告与预测,并认为,有了中国(市场)的支持, 50G PON的出货量将明显胜出(同25G PON相比)。

Deployments of FTTx accelerated in 2021 and LightCounting raised its forecast for this market segment in 2022-2027, driven by strong uptake of 10G PON.

With 10G PON deployment well underway, the industry is looking at what will come next. What is the best option?

25G, 50G, and 100G/200G PONs have been considered as successors to 10G PON by the IEEE, ITU, FSAN and other standards bodies. Symmetric 25G PON has no standard but instead an active MSA with 17 members including AOi, AT&T, Ciena, Chunghwa, and Nokia.

Among leading access equipment vendors, Nokia has emerged as a champion of 25G PON and already has a commercial 25G-capable combi-PON OLT available (which they call ‘multi-PON’). On the other hand, Huawei has gone all-in on 50G-PON, supported by the big three Chinese network operators.

Network operators around the world are likewise divided into camps favoring 25G and those supporting a move directly to 50G from today’s almost universal favorite XG(S)-PON.

Against this backdrop, LightCounting looked at the history of similar optical speed transitions, those from 10G to 40G/100G Ethernet, and from 100G to 200G/400G, for insight into how this PON transition is likely to happen.

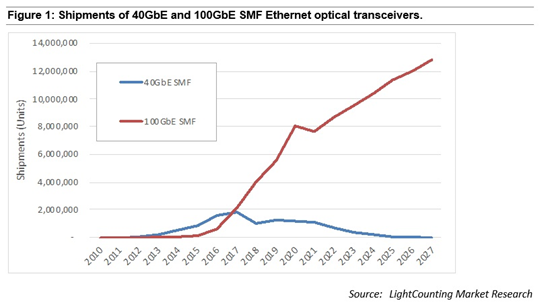

Figure 1 compares shipments of single mode fiber (SMF) 40GbE and 100GbE transceivers.

40GbE proved to be a useful step forward, but 100GbE emerged as a clear winner by 2018. Even so, close to 10 million units of 40GbE SMF transceivers were shipped in 2010-2021, offering a significant market opportunity to suppliers.

Similarly, our data shows 400G is proving to be a clear winner versus the intermediate speed of 200G as the next common speed beyond 100G.

What we learned from the above can be summarized as:

· Higher data rate products capture a larger market share and have a longer lifecycle.

· Choices made by the largest customers define a path for the market.

· Price reductions come surprisingly fast; the highest volume products have the lowest cost.

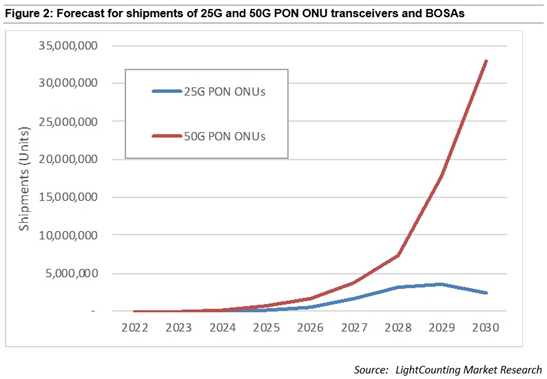

With these history lessons in mind, LightCounting offers its estimate for future shipments of 25G and 50G PON ONUs, illustrated below:

With China’s backing we believe that 50G PON will emerge as a clear winner versus 25G in terms of total units shipped, starting with the very first deployments of both 25G and 50G PON. All the largest customers – China Mobile, China Telecom, China Unicom, and several European operators – have selected 50G PON for their deployments. Several service providers in North America and Europe may prefer 25G PON, but the scale of these deployments will be relatively small compared to 50G PON deployments.

---本文内容来自LightCounting。如所选内容不宜公开自由传播,请及时通过电子邮件或电话通知我们,我们将及时处理---

上一页 : 科大亨芯将出席第24届CIOE中国光博会